Jul 1

2025

MDaudit and Streamline Well being Announce Definitive Merger Settlement

MDaudit, a portfolio firm of Bregal Sagemount & Primus Capital and an award-winning cloud-based steady threat monitoring platform that permits the nation’s premier healthcare organizations to reduce billing dangers and maximize revenues, and Streamline Well being Options, Inc., a number one supplier of options that allow healthcare suppliers to enhance monetary efficiency, introduced in the present day that they’ve entered right into a definitive merger settlement pursuant to which MDaudit will purchase Streamline.

This mixture brings collectively two organizations that share a standard imaginative and prescient: enabling healthcare organizations to broaden affected person care and entry by enhancing monetary stability. By becoming a member of Streamline’s pre-bill integrity options with MDaudit’s strong billing compliance and income integrity platform, the events imagine that the mixed group will likely be uniquely positioned to unify disparate information silos, broaden govt insights, and drive coordinated actions throughout the income cycle continuum to speed up income outcomes and mitigate threat.

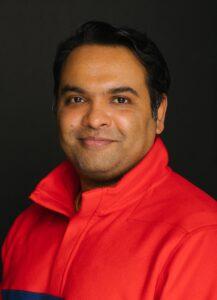

“At a time when well being methods are going through mounting monetary and operational pressures, we imagine the longer term belongs to those that can join the dots throughout the income cycle continuum with data- and AI-driven options,” mentioned Ritesh Ramesh, CEO of MDaudit. “Streamline’s RevID and eValuator options complement MDaudit’s present strengths in billing compliance and income integrity capabilities by enabling pre-bill visibility in real-time to unlock income alternatives. These options replicate our shared perception that human-driven income cycles deserve proactive, systemwide intelligence with closed suggestions loops which might be actionable”.

“MDaudit and Streamline have at all times believed that essentially the most subtle expertise gained’t drive profitable outcomes with out an unwavering concentrate on buyer satisfaction,” mentioned Ben Stilwill, CEO of Streamline Well being. “Our groups have constructed belief by being true companions to our prospects. Collectively, we’re constructing a broader platform that displays the fact of in the present day’s income cycle: distributed groups, disconnected information, and immense accountability. Collectively, we’re delivering foresight and motion; not simply studies or alerts.”

Transaction Abstract

On the efficient time of the merger, a wholly-owned subsidiary of MDaudit will merge with and into Streamline, with Streamline surviving the merger as a wholly-owned subsidiary of MDaudit. The closing of the transaction is topic to sure customary closing situations, together with approval of the merger settlement by the Streamline stockholders. The transaction just isn’t topic to a financing situation, and MDaudit intends to finance the transaction utilizing a mix of money readily available and accessible funds from present credit score amenities.

The merger is predicted to shut in the course of the third quarter of 2025. Following the closing of the merger, Streamline’s frequent inventory will not be listed on the Nasdaq Inventory Market, and Streamline will develop into a non-public firm.